Here is some insight to help you when buying a home with financing today. The real estate market since at least last year ago has become a buyers’ market. Not just a regular buyers’ market but a cash buyers’ market. This is causing a large pool of buyers that want to buy a home but their financed offers are not being easily accepted. In most metropolitan areas, the old saying “Cash Rules” comes into play.

When we talk about using financing to purchase a home the financing could be one of the following types of loans:

- Conventional Loan

- FHA Loan

- Conventional Non-QM (Qualified Mortgage)

- VA Loan

- Jumbo Loans

A financed home buyer cannot purchase a home in today’s market and compete head to head with a cash buyer. The reason why a financed buyer cannot compete head to head with a cash buyer is because of the “Home Appraisal”. With financing, the mortgage lender is going to lend on the lesser of the following two items:

1. The Purchase Price or

2. The Appraised Value that is established by the real estate appraiser.

Buyers that are financed buyers usually do not have enough resources to pay the difference between the Purchase price and the Appraised value. This is another reason why a seller prefers accepting a cash offer.

Because of this appraisal value issue, a seller would rather take the bird in the hand which is the buyer that offered cash even if it matched what you offered dollar for dollar. Your, financed offer, has a chance of not closing because of the appraised value and the seller wants a sure thing.

Today, cash dominates!!!

Suggestions to Consider

I have been in the mortgage industry for 20+ years and this is what I have been advising my clients to consider if they seriously want to purchase a home with financing. The list is not in any order of importance but in generality:

- Search Areas: do not search for a home in the “hot spots” where everybody wants to The hot spots will have bidding wars and a financed buyer will lose out to a higher-priced cash offer.

Solution: Look at areas that are outside of the “Hot Spots”

Why: There will be less competition

- Days on the Market: Pay attention to how long properties are on the market for sale. This is a big indicator. If the property was a hot property and everybody wanted it then the property would have sold within a 7 – 20 day period.

Solution: Look for properties that are on the market for more than 30 days – Side note –why did it not sell fast? What is wrong with the property?

Why: There will be less competition

- Magazine Ready: Do not look for those homes that look like they were just in a magazine and ready to move in. If you loved it, how many other cash buyers loved it also?

Solution: Look for homes that need some work that you can have done at your speed and you can control the expense to some degree. Certain repairs must be done before closing – Contact Unlimited Mortgage Lending to discuss.

Why: There will be less competition

- Flow: When you walk into a property, are you walking from the front door into the bathroom or the main Is there a good flow from one room to another?

Solution: Look for homes that the flow is not smooth and easy. Changing Archways to a Squared entrance can be done or moving a wall could possibly be done (if not load-bearing) to increase or decrease a room size. If you are not handy, then you can research and hire qualified contractors to do the work for you at your pace and within your budget.

Why: There will be less competition

- Coverings are Cosmetic: Paint, wallpaper, tile, faux wood floors, are all cosmetics, lipstick, and blush. All of these coverings were done by the seller to suit their style that they loved. It can all be changed. What I mean by this is that you can change any or all of this to suit your style and not the sellers’ style.

Solution: Look at the property with an open eye to this fact and that you can change these at your own pace to your own style.

Why: There will be less competition

What you Should also Think About

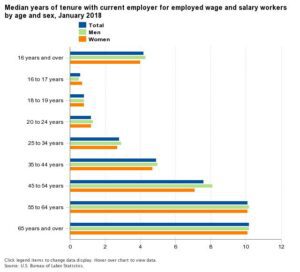

In today’s world, most of us have a car to go to and from work, it is just a question of how long it takes us. Something to note is that we change homes less than we change our jobs in our lifetime. Per the National Association of Realtors (NAR) “As of 2018, the median duration of homeownership in the U.S. is 13 years”.

In the 2018 Employee Tenure Summary, “the median employee tenure was 4.3 years for men and 4.0 years for women”. So the point here is that finding the right property is more important to us than where our job is located. Points to consider:

- Lifestyle: What type of lifestyle are we living or want to live in? Do we want to always be on the run where grass does not grow on rolling stones or do were want calm and tranquility without the stress and watch the kettle boil? Maybe you want the lifestyle of luxury or you are just a down-to-earth type of person. There are areas to live in that would suit any of these

- Education: Do you have children that you have to consider the education system? How long are you going to have to live in the district while your kids grow up and have stability within the same school district till they graduate?

- Emergency Services: With children, there will always be an If you personally have medical issues, how far are you from getting emergency help? Are they 7 or 20 minutes away from your child’s broken arm or from your heart attack?

- Neighborhood: We all have our likes and dislikes and this also goes for the type of neighborhood that you are considering moving to. You should always check out a neighborhood by a few drive-bys. I recommend trying to drive thru the neighborhood in the early am to see how many children catch the school bus, then again in the evening after everybody has gotten home from work to see if there is any outside would also drive by on Saturdays just to see the activities going on.

- Vehicles: Pay attention to the number of vehicles in a driveway and also how many and also the type of vehicles. Is there commonly a 1 vehicle / 1 bread earner household? What types of vehicles are they – common Toyota or luxury Mercedes? Are there commercial vehicles?

All of these points are something to consider but not the only items when shopping for a home. Your realtor would be a great resource to find out about a neighborhood.

In summary, it is very hard for a financed buyer to compete against a cash buyer because of the appraisal. The seller wants a sure thing. Thinking “Outside of the Box” will help you find that home you would like that there is a higher probability of the seller accepting your offer. You just have to adjust your thought on how you are searching for the right new home to buy.

If you need more help, please contact us here at Unlimited Mortgage Lending and we would be happy to help you. 561-898-1008